[vc_row][vc_column][vc_column_text]What is TIMS? Is a Tax Invoice Management System that is an upgrade of the current Electronic Tax Register (ETR). In order to streamline VAT administration, KRA is in the process of implementing of Tax Invoice Management System (TIMS) which will enhance the current ETR program that was rolled out in 2005.

What is the origin of TIMS?

On September 2020, the cabinet secretary of the national treasury gazetted the Value Added Tax (VAT) (Electronic Tax Invoice) regulations to usher in a new electronic tax invoice regime. This regulation required all VAT registered taxpayer to comply within twelve months upon gazettement. However, KRA issued a public notice citing its plan to rollout the new electronic tax invoice requirements commencing 1st August 2021. The public notice further gave a twelve-month transition window from the rollout date for the tax payer to comply. This means that all VAT taxpayer should onboard on the new system by 30th July 2022.

What are the objectives of implementing the Tax Invoice Management System?

Tax Invoice Management System will help in the following;

- Plugging loopholes that result from the weaknesses of the ETR program.

- Improving accuracy in automated VAT data management

- Minimizing VAT fraud through invoice data verification

- Foster tax compliance and minimize tax revenue leakage.

What are the benefits of the Tax Invoice Management System (TIMS) to the VAT Taxpayers and the general public?

The general public and VAT taxpayers will benefit from the following;

- Encourage and promote a fair business environment

- It will make it faster to process VAT refunds

- VAT returns filing will be simplified

- Tax register activation will be automated which is added advantage to the VAT taxpayers

- With the system there will be a non-intrusive verification of the tax process

- It will help to build trust between the customer and the business entity

- TIMS assist in enhancing tax compliance

How do you comply as a VAT taxpayer?

In order to comply with the regulation, a VAT-registered taxpayer should acquire a compliant tax register from KRA-approved ETR Suppliers. The list of the approved ETR suppliers of compliant tax registers is provided on the KRA website.

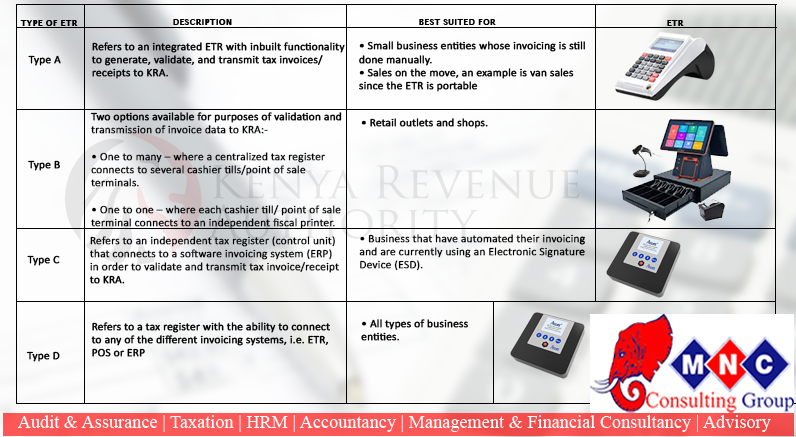

What are the types of the ETRS model?

The approved suppliers and manufacturers have different ETR models which are categorized into;

Who requires an ETR Device?

The regulations requires businesses with an annual turnover of at least Kshs.5 million to install electronic tax register (ETRs) connected to KRA online system (Itax) as an upgrade of the current manual tax register.

What are features one should look for when onboarding TIMS?

- Integration with trader systems, i.e. ETRs, ERPs, and Point of Sale systems (POS).

- Standardization and authentication of tax invoices issued by VAT traders on a real-time basis.

- Seamless integration with iTax.

- A module for storage of tax invoice data.

- Verification of the validity of a tax invoice for use by officers, traders, and the general public through the Tax Invoice Checker on the iTax portal or Mobile app.

What are the features of a valid tax invoice?

- The invoice should have the pin and the name of the trader

- It should have a serial number

- It should contain the buyer PIN which is optional

- The invoice should have the total gross amount and total tax amount

- It should contain the tax rate

- It should have a unique register identifier

- It should contain a digital signature

How does TIMS operate?

TIMS operates by the use of a control unit connected or integrated into the existing trader system. The control unit performs the function of tax invoices validation, encryption, signing, transmission, and storage. The communication between the control unit and the TIMS application server at KRA can only be done over the internet. However, the connection between the control unit and the trader system does not have to be on the internet. It can either be integrated into the trader system or attached to it. Occasionally, the trader is required to access the internet in order to enable the transmission of the data to TIMS.

What happens in case of loss of internet connection?

The taxpayer should continue using the tax register as usual. Once the internet connectivity is restored, the invoices generated and stored in the tax register’s memory will be automatically transmitted to TIMS at KRA.

Which internet should be used?

The device has the ability to connect to three communication protocols i.e., Wi-Fi, 4G /3G and Ethernet connection.

What are requirement for onboarding TIMS?

To onboard TIMS one should meet the following requirements;

- One should be a registered for VAT in accordance with the provision of the VAT Act 2013.

- Have an invoicing system with the capability to transmit invoices to KRA systems.

- Have internet connectivity.

How does a VAT taxpayer come on board with TIMS?

The following is the process of onboarding;

- Acquire a compliant tax register from KRA suppliers from authorized manufacturers

- To enable activation, the ETR supplier configures the details of the tax register and the VAT taxpayer who is already registered for VAT on iTax

- The VAT taxpayers receive an email from iTax confirming the details of the tax registers assigned to them which they are supposed to accept.

- On accepting the tax register is activated by KRA and becomes ready for use

What is the effective date of TIMS?

The effective date for the commencement of TIMS will be on 1st August 2022

What is the extended deadline date for complying with Tax Invoice Management System (TIMS)?

The deadline date of complying with the regulation of Tax Invoice Management System (TIMS) was extended to 30th September 2022. This was due to VAT taxpayers request to be given more time to acquire and activate the KRA TIMS enabled device.

What are penalties for not onboarding TIMS?Failure to comply with the regulation is an offence which attracts penalties as specified in section 63 of 2013. Therefore, for non-compliance one shall be liable to a fine not exceeding Kshs. One million, or imprisonment for a term not exceeding three year or to both.

What are our recommendations to all VAT- registered taxpayers?

- That all VAT-registered taxpayers should consider onboarding TIMS as soon as possible.

- That all VAT- registered taxpayers to consider adopting TIMS earlier in order to avoid challenges during the setup period.

- That considering implementing the system earlier to allow a smooth running of the system before the mandatory due date of compliance.

To learn more about TIMS operation do not hesitate to contact us. If you need to acquire an ETR device follow the link

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

Book Now

[fc id=’3′][/fc][/vc_column_text][/vc_column][/vc_row]